habito

#fintech #scaleup

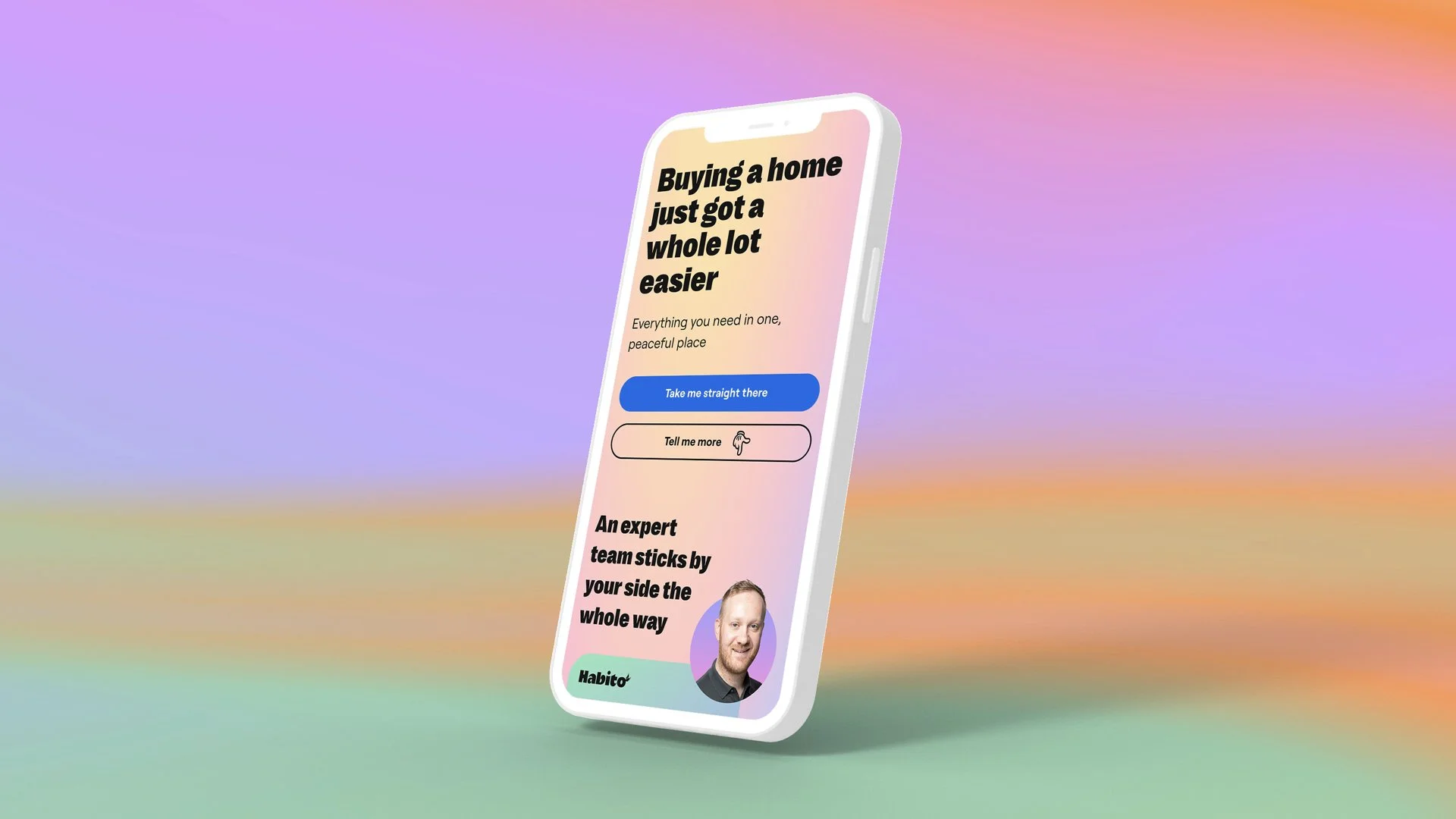

home-buying made easier

Summary

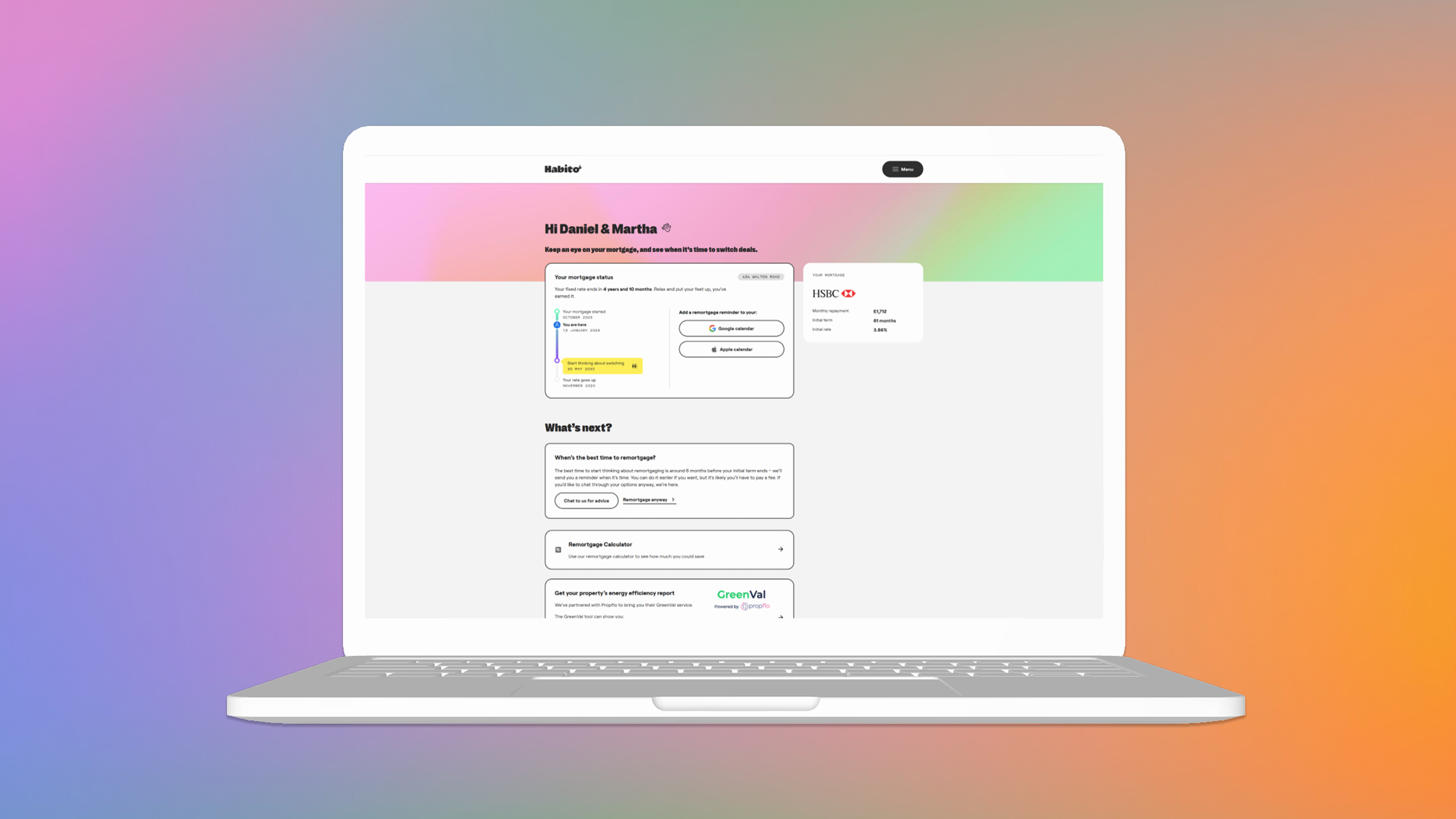

Habito is a UK-based digital mortgage broker transforming one of life’s most complex and intimidating financial decisions into a clear, transparent, and human experience. By combining whole-of-market mortgage data, automation, and expert mortgage advice, Habito enables customers to search thousands of mortgage deals, apply online, and secure the right mortgage entirely digitally without paying advice fees.

Over time, the platform has evolved beyond a single mortgage journey into a family of services, including Habito Plus and Habito One. These services support customers across buying, moving, remortgaging, and homeownership, while enabling Habito to scale sustainably as a business.

Challenge

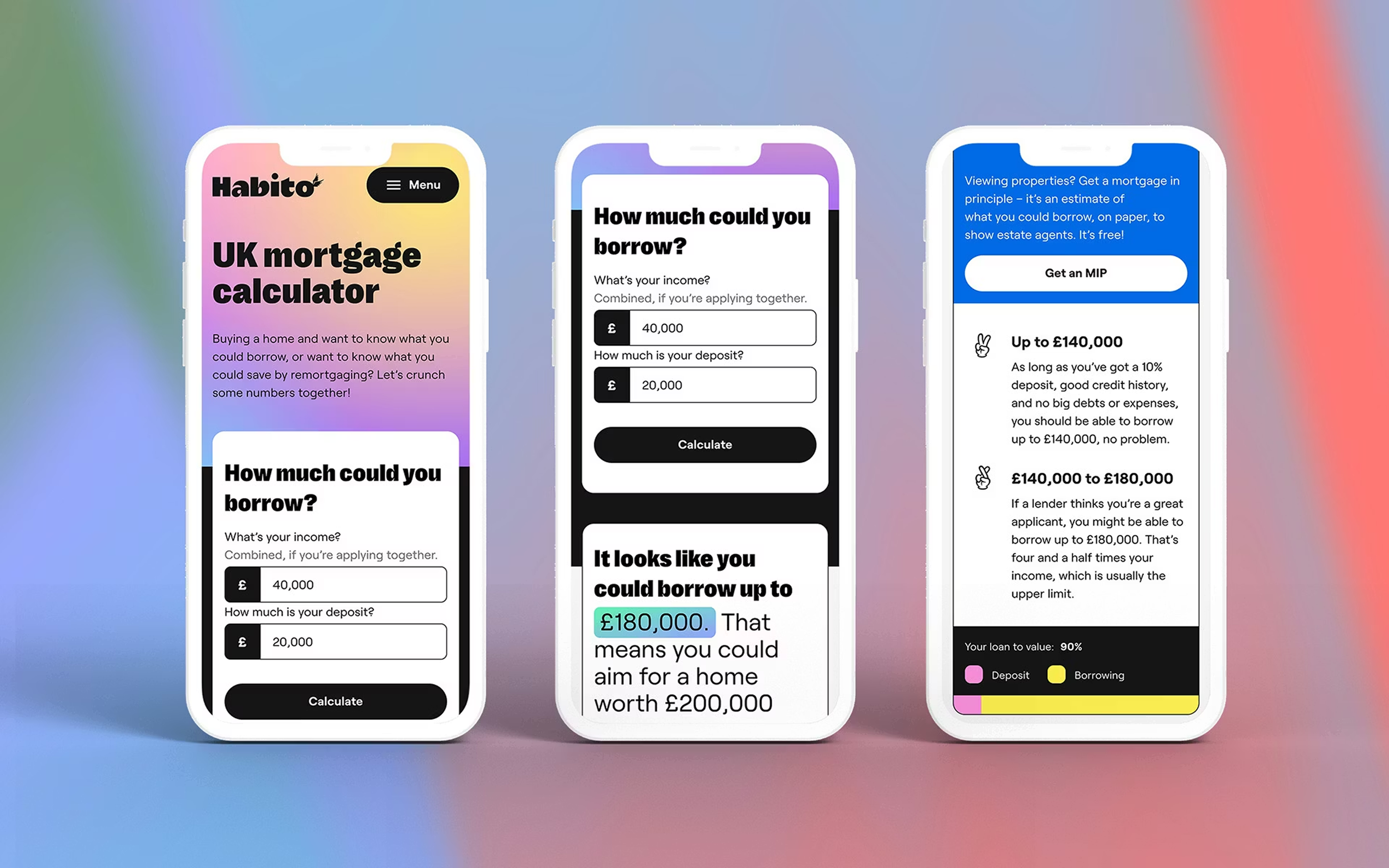

Mortgages are one of the most significant financial commitments people take on, yet the process is widely regarded as stressful, confusing and laden with jargon. Conventional mortgage broking is expensive, slow and often limited in scope with applicants unsure whether they’re getting the best possible deal. Habito set out to change that by creating a truly modern, digital mortgage experience that puts the customer in control.

As Habito scaled, the challenge became more complex. By Series D, the company needed to continue simplifying the end-to-end mortgage experience for customers, expand into adjacent services like home-buying and ownership, and shift from growth-at-all-costs to profitability and operational efficiency without compromising experience quality, trust, or speed.

Research & Strategy

Buying or remortgaging a home is one of the most emotionally charged financial decisions people make. Research across customers showed a consistent mix of anxiety, confusion, and lack of confidence. People did not just want access to mortgage deals. They wanted reassurance they were making the right decision, clarity about what would happen next, and confidence they were not being taken advantage of in a system they did not fully understand.

At the same time, mortgages rarely exist in isolation. Customers were navigating offers, surveys, conveyancing, insurance, and deadlines, often across multiple disconnected providers. Internally, advisors and operations teams were dealing with fragmented tools and manual processes, which slowed progress and made it harder to deliver a calm, joined-up experience at scale. To grow sustainably, Habito needed to meet customer needs while also reducing internal complexity and operational cost.

To align teams and guide decision-making, we articulated a set of experience principles rooted in research and operational reality. These principles helped secure executive alignment and provided a clear lens through which to judge the work as Habito expanded beyond a single mortgage journey.

Clear

Mortgages are intimidating enough without unnecessary jargon or hidden complexity. We focused on making every step, requirement, and outcome easy to understand for first-time buyers and experienced homeowners alike. Clarity meant plain language, visible progress, and an experience that helped customers feel informed rather than overwhelmed.

Supportive

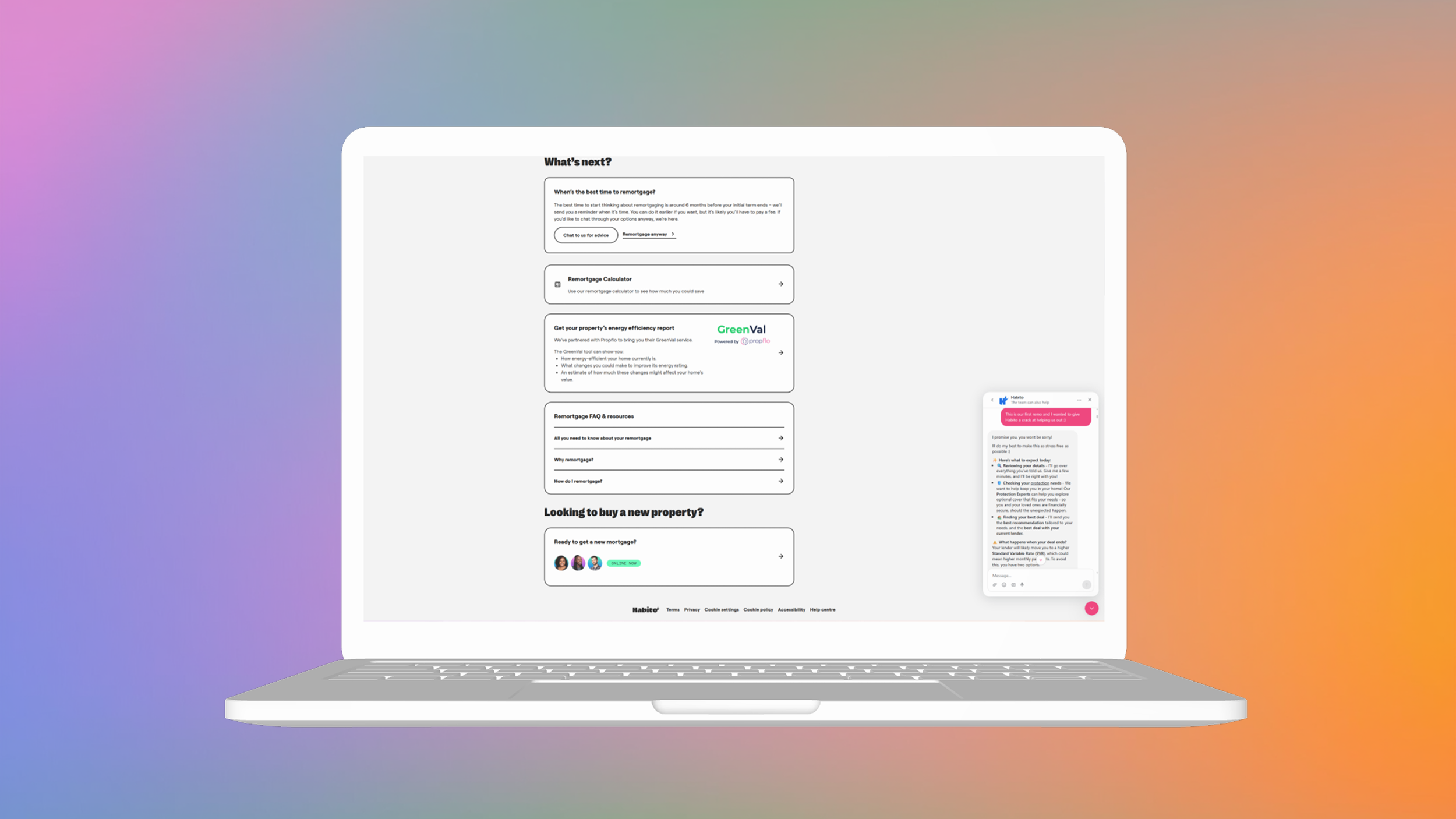

Customers needed to feel guided, not sold to. We designed the experience to balance smart automation with access to real human expertise at key moments. Whether through digital tools or advisor conversations, the service needed to reassure customers that someone was in their corner throughout a high-stakes decision.

Efficient

Time, effort, and repetition were pain points for both customers and advisors. We prioritised removing unnecessary steps, reducing duplication, and streamlining workflows. Efficiency was not about rushing people through the process, but about respecting their time and cognitive load while enabling the business to scale.

Joined-up

A mortgage is part of a wider home-buying and ownership journey. We designed the platform to connect related services into a coherent experience, rather than a series of disconnected transactions. This principle directly informed the evolution of services like Habito Plus and Habito One, allowing Habito to support customers across buying, moving, and owning a home.

Solution

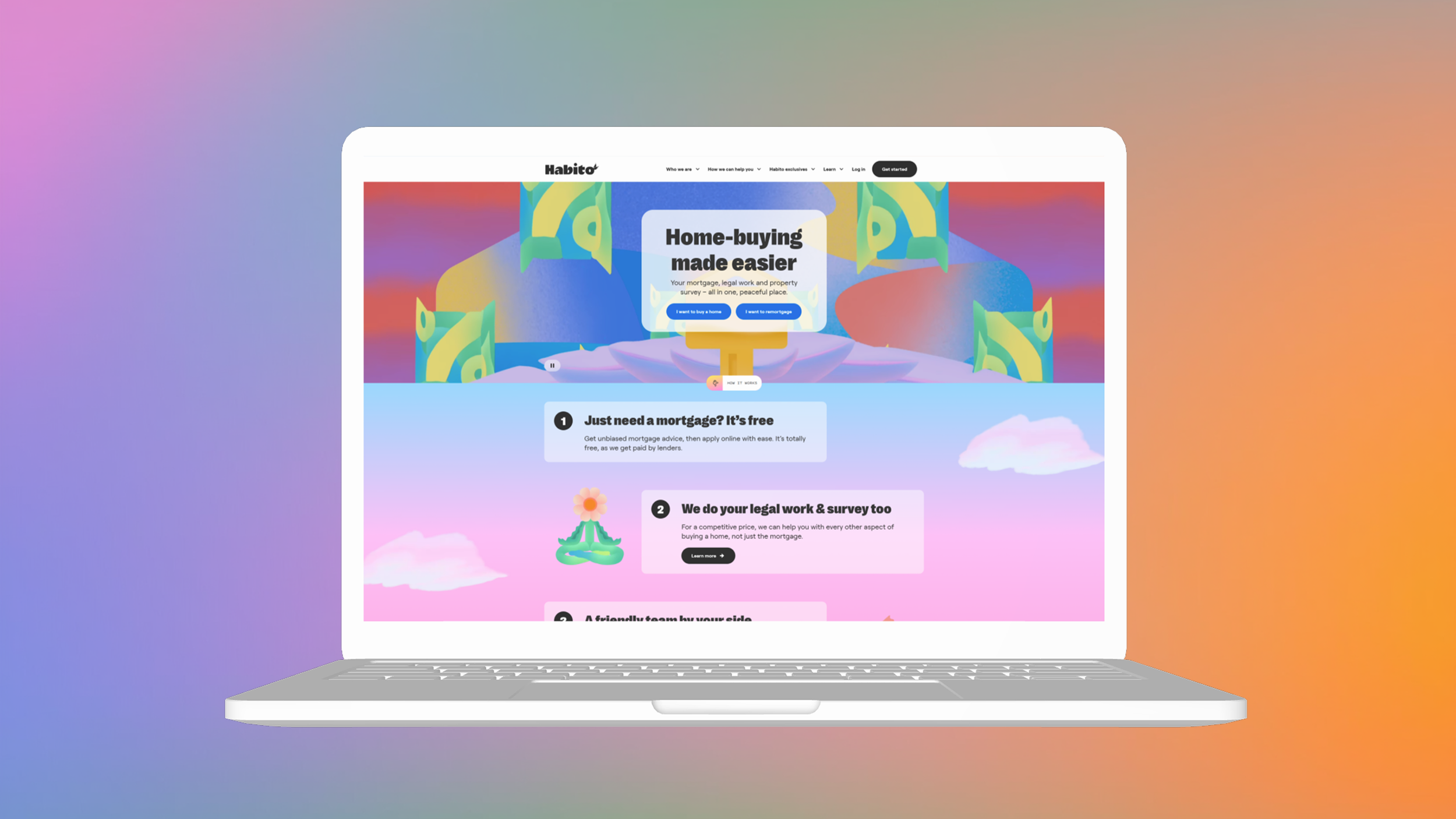

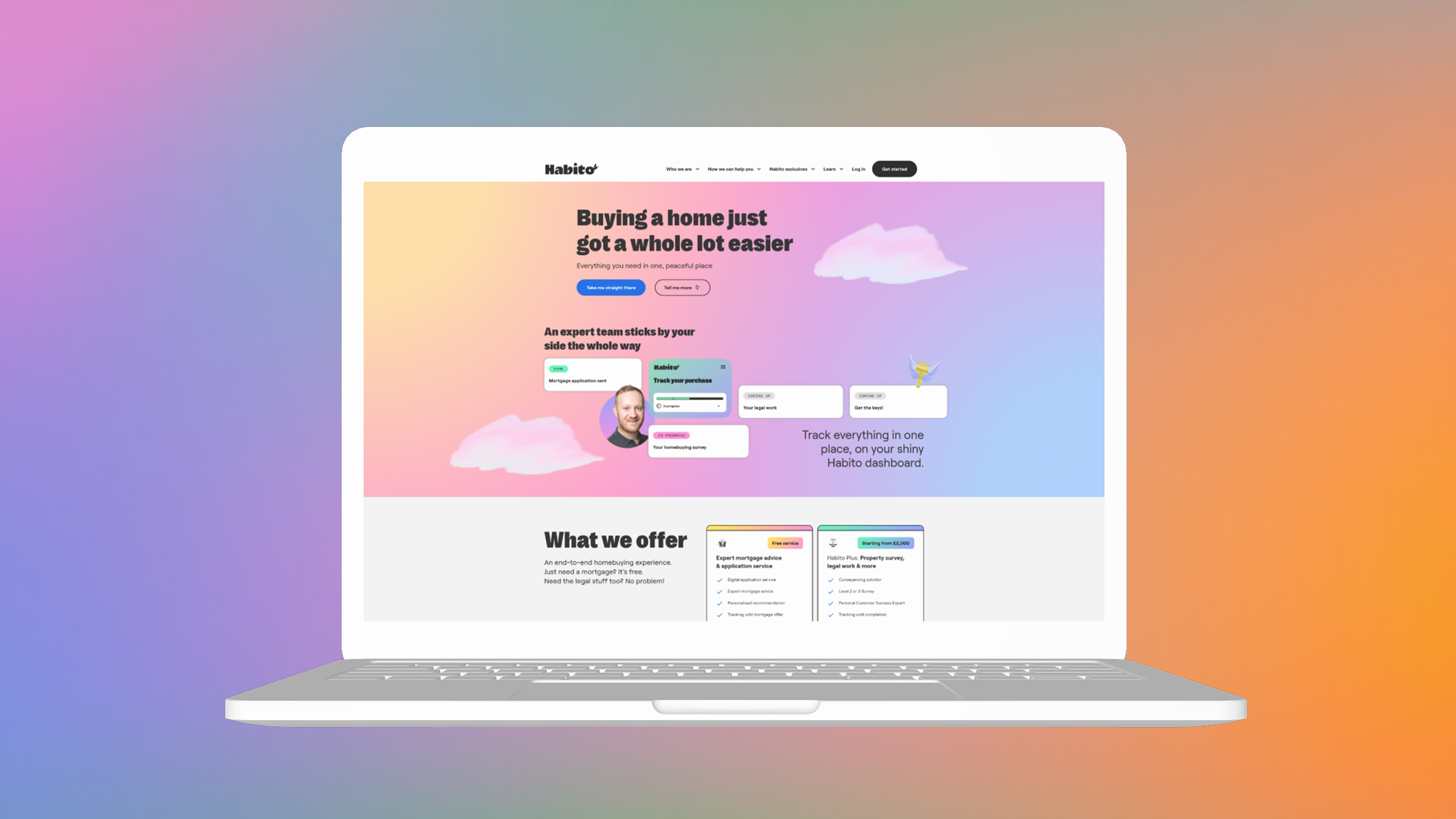

Habito evolved from a digital mortgage broker into an integrated platform supporting multiple customer needs and business models.

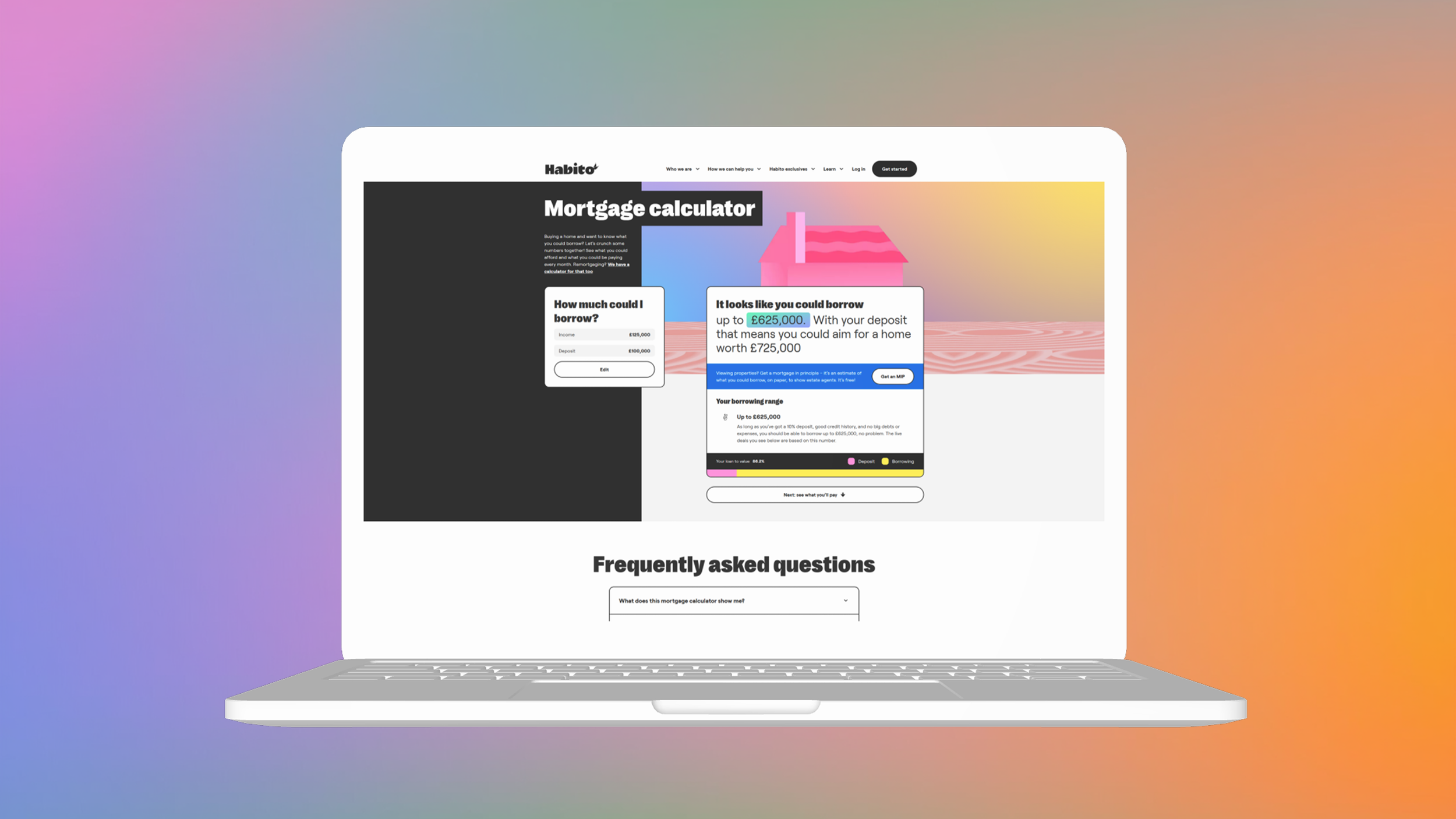

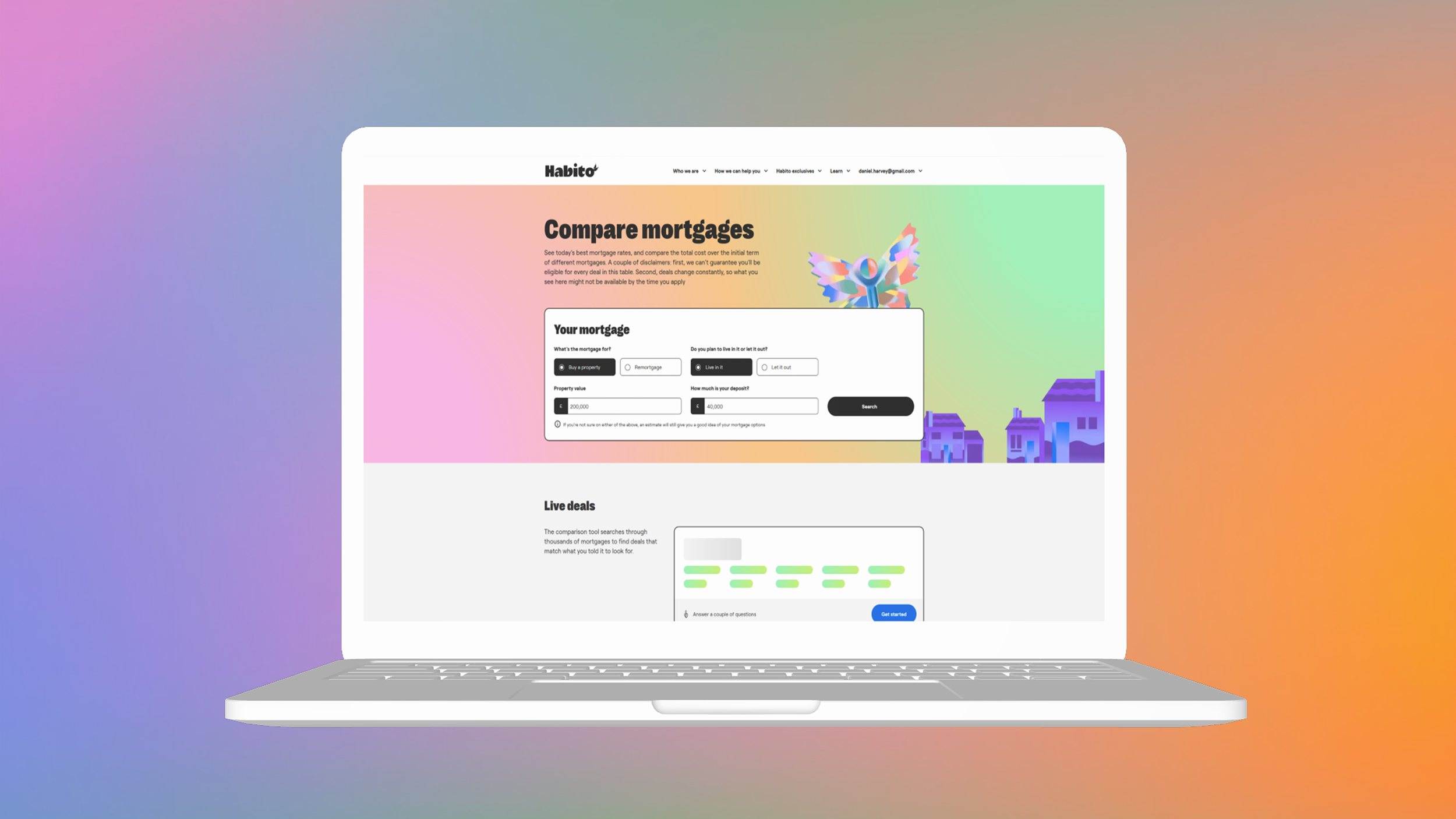

Core Digital Mortgage Platform

Customers can explore thousands of mortgage products using whole-of-market comparison, with smart matching technology doing the heavy lifting. The end-to-end mortgage journey is completed online, including applications, document uploads, and progress tracking. Expert mortgage advisers are available via chat or phone from first conversation to completion. By removing advisory fees, Habito eliminated a major financial and psychological barrier to entry.

Habito Plus. A Smarter Way to Buy a Home

Habito Plus extends the core mortgage experience into the home-buying journey itself. It combines mortgage advice with dedicated support through offers, surveys, conveyancing, and completion. The service reduces stress and uncertainty by providing a single, joined-up experience at a moment when multiple disconnected providers traditionally compete for attention.

Habito One. End-to-End Homeownership

Habito One expands the platform further by supporting customers beyond purchase. Mortgages, insurance, and ongoing homeownership services are bundled into a single subscription-style offering. This reframes Habito from a one-off transaction into a long-term partner across the homeowner lifecycle.

Internal Platforms and Operations

Low-code internal tools dramatically improved advisor productivity and reduced operational cost. Unified systems enabled faster case handling, clearer visibility, and better customer outcomes. Design-led product marketing and rapid prototyping supported customer validation, partner conversations, and investor storytelling.

impact

£9B

in mortgage revenue generated through Habito One & Plus

10X

improvement in operational volume

20%

improvement in operational efficency

4.9/5

rating on Trustpilot

Role

Product Design Director

Skills

Creative Direction, Product Design, Interaction Design, Information Architecture, Strategy, UX Research, Copywriting, Branding, Staff Leadership & Development

Team

Alice Duddy, Kate Gorrell, Emma Jones, Will Jones, Andrea Krndija, Christine Lejeune, Pia Leung, Christopher Magoba, Afy Nourallah, Paolo Riozzi, Elliot Svensen, Jack Young

COMPANY / Launch

Habito / 2021 — 2023

Get in touch

I'm always open to interesting opportunities. Drop me a line if you'd like to discuss ways I could:

• Improve your product or brand

• Speak at your event or conference or on your podcast

• Write for your publication